STATEHOUSE REPORT | ISSUE 24.02 | Jan. 10, 2025

BIG STORY: Tax cuts could be bait-and-switch, experts suggest

MORE NEWS: Is registration by party coming to S.C. as session opens?

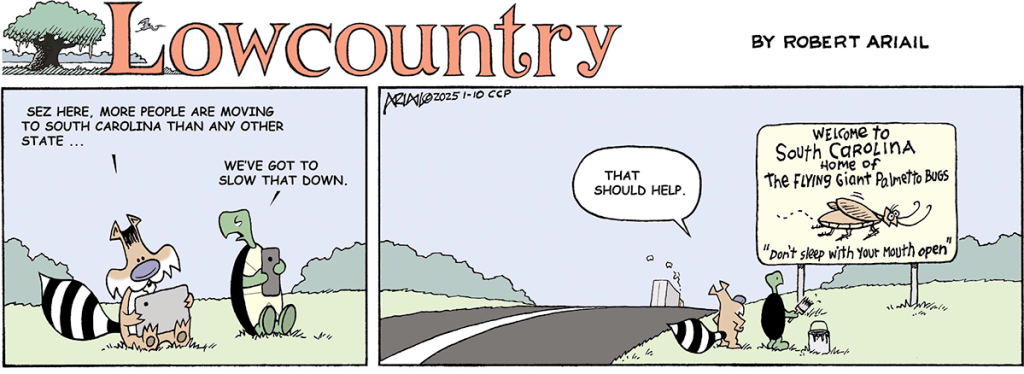

LOWCOUNTRY, Ariail: Don’t sleep with your mouth open

BRACK: Focus on what’s real, not made-up politics

MY TURN, Ulbrich: Tips from S.C. on saving Social Security

MYSTERY PHOTO: Old white house

FEEDBACK: Send us your thoughts

Something new for 2025

As Statehouse Report enters its 24th year of online publication this week, we have started something new: primary publication of our South Carolina content on the Charleston City Paper website.

You’ll still get a weekly email every Friday, but it may look a little different. (You’ll have to click the full issue to find all of our features, including the Mystery Photo). One thing is guaranteed – you’ll still get the content you know and love every week. – Andy Brack, editor and publisher

Proposed state tax cuts could be bait-and-switch, experts suggest

By Jack O’Toole, Capitol bureau | Imagine a car dealership where the sticker prices were high — but thanks to automatic rebates and deep discounts on all but the most expensive luxury vehicles, it was actually the cheapest place in town for the average person to buy a car.

Experts say that’s how South Carolina’s current tax code works for most state residents — high sticker-price rates, but some of the lowest tax bills in the country after deductions, credits and exemptions.

And it’s why they warn that state GOP leaders’ promise of “historic” tax cuts in the 2025 legislative session could lead to a bait and switch, where tax rates go down but the average South Carolinian sees no real benefit — or possibly even a backdoor tax increase.

After all, if the car dealer eliminates or caps rebates and discounts to slash the sticker price on luxury automobiles, the person buying a regular car could easily wind up paying more.

“Since 2021, about half the states in the country have cut income taxes,” said Neva Butkus, a tax policy analyst with the Institute on Taxation and Economic Policy in Washington, D.C.. “And they eventually have to pay for that with something — usually raising or expanding sales taxes and fees or kicking responsibilities down to the locals, all of which ask more of lower- and middle-income families.”

Fast facts about the current system

To follow the debate, experts say it helps to know a few facts about the state’s current tax system and the debate surrounding it.

- South Carolina’s $14 billion general fund relies on two principal sources of tax revenue — the income tax, which produces about half of all state revenues, and the sales tax, which produces almost 40%. The state also collects an additional $2.7 billion from corporate taxes and other sources. .

- At 6.2%, S.C. has the highest nominal income tax rate in the Southeast, though it’s set to fall to 6.0% under current law. GOP leaders in the Statehouse have pledged to get it “below that of our neighbors” during this legislative session — presumably referring to Georgia’s 5.5% and North Carolina’s 4.5%.

- In theory, the average Palmetto State resident is in the state’s top 6.2% income tax bracket — but in reality, only pays 2.7% after deductions, credits and income adjustments. Experts say this typically results in lower tax bills than in Georgia or N.C.

- 45% of South Carolinians pay no income taxes at all, while the top 10% of income earners pay almost 65% of all income taxes collected. As a result, any major cut would primarily benefit high-income residents.

- The state sales tax is 6% — but due to a broad array of exemptions, including food, medicine and most services, it only applies to about 30% of the things people buy. In North Carolina and several other states, lawmakers have “paid for” income tax cuts in part by expanding the sales tax to cover more goods and services. And by extension, that meant that average wage-earners subsidized tax cuts for the wealthy.

The case for tax reform, including rate cuts

Despite South Carolina’s low rates for most people, the state’s current tax system is far from ideal, according to many tax policy analysts.

First, it fails the basic test of transparency due to the wide gulf between the official rates and what most people pay, adding complexity for collectors and confusion for residents. And second, because the tax rate is actually higher than the Southeastern average for wealthier individuals — the luxury car buyers who don’t enjoy the full benefits of rebates and discounts — it can limit their willingness to move to the Palmetto state and invest in its economy, leading to lower growth for everyone.

“Right now, we have the highest [income tax] rates in the Southeast — higher than North Carolina, higher than Georgia and Mississippi and Alabama, and higher also than Tennessee and Florida, which have zero,” said Sam Aaron of the S.C. Policy Council. “That’s a huge deterrent to people who are looking at South Carolina.”

Moreover, while Aaron says “a portion” of the money needed to fund a major tax cut would probably come from expanding the sales tax to cover more items, he believes the bulk of it can and should come from spending reductions.

“Over the past decade our state budget has doubled from $6.1 billion to $12.4 billion, which is just off the charts,” Aaron said. “So the main way you’re going to have to go about this is with some sort of spending restraint . . . like our ‘Responsible Budget’ plan.”

Under that plan, which was released Jan. 6, future state spending increases would be limited to population growth plus inflation.

But some, such as S.C. Rep. Jordan Pace (R-Berkeley), head of the House Freedom Caucus, favor an even more aggressive approach to spending cuts, with an eye toward eliminating the income tax entirely.

“The question most people ask is ‘where are we gonna find the money?’ or ‘what are we going to replace it [the income tax] with?’” Pace told Statehouse Report on Jan. 6. “And my answer would be nothing. Cut spending.”

Still, concerns remain

S.C. Senate Minority Leader Brad Hutto (D-Orangeburg) agrees that a carefully crafted tax cut could make sense for South Carolina, but says “the devil’s in the details.”

“We all support tax reform and think it’s a very appropriate discussion for us to have,” Hutto said in a Jan. 6 interview. “Nobody wants any citizen to be paying any more taxes than they absolutely need to — but it’s kind of hard to just up and say we’re going to change one tax without doing a global look at how it’s gonna affect every citizen and the state as a whole.”

What’s more, Hutto notes that the kind of unprecedented spending cuts some of his colleagues are discussing may not be possible as the state’s population continues to explode.

“We’re the fastest growing state in the nation, which means that as people move in here, our infrastructure needs — roads, schools, fire departments, water and sewer — are growing, too,” Hutto said. “We just need to make sure that as we lower one tax, we don’t unwittingly leave ourselves without enough money to run state government.”

Wesley Tharpe, the senior advisor for state tax policy at the Washington-based Center on Budget and Policy Priorities, says he shares those concerns about basic services. But even more, he argues, draining state government coffers with upper-income tax cuts limits the flexibility future leaders may need to address critical concerns.

“Those could be over-the-horizon investments like strengthening the road network, or environmental investments along the coastline in an era of climate change, or maybe bolstering the foster care system,” Tharpe said. “And whenever these big tax cuts are passed, there’s an implicit choice being made not to hold onto those dollars to make those important investments down the road.”

- Have a comment? Send to: feedback@statehousereport.com.

Is registration by party coming to S.C. as session opens?

By Jack O’Toole, Capitol bureau | Statehouse handicappers say 2025 may be the year that lawmakers require South Carolinians to declare allegiance to one political party or the other when they register to vote, a long-time wishlist item for many GOP legislators.

![]() The 2025 session of the S.C. General Assembly will open on Jan. 14.

The 2025 session of the S.C. General Assembly will open on Jan. 14.

Under current law, Palmetto State residents register without reference to political party and can then participate in the party primary of their choice. But two Republican-sponsored bills in the S.C. House, H.3310 and H.3643, would change that by requiring partisan registration.

The switch would allow the GOP to close its primaries, limiting participation to registered Republicans. Political observers believe this would likely have the effect of moving the party further to the right by excluding registered Independents and moderate Democrats.

S.C. Rep. Jordan Pace (R-Berkeley), leader of the hard-right S.C. Freedom Caucus, says he supports the change.

“One of our main priorities is closed primaries,” Pace told Statehouse Report last month. “That’s high on our list because it not only achieves something our constituents have told us they want, but has a major trickle-down effect on everything else.”

But Lynn Teague, vice president of the nonpartisan League of Women Voters of South Carolina, says a switch would not be in the interests of nonpartisan voters.

“The League opposes both bills,” Teague said in a Jan. 9 statement. “Although either would be acceptable if all unaffiliated voters could vote in any primary, without further conditions.”

Despite opposition from the League and other nonpartisan groups, Teague calls the likelihood of passage this year “especially high,” given the GOP’s new supermajorities in both chambers of the state legislature.

In other recent news

Charleston to host major national Democratic forum on Jan. 24. Charleston will be in the glare of national politics Jan. 24 when it hosts a forum among candidates who want to be the next chair of the Democratic National Committee, sources confirmed this morning.

Lawmaker warns of uncontrolled growth and development. On the Jan. 10 episode of the Conversing with Nature podcast, S.C. Rep. Spencer Wetmore (D-Charleston) warned the state. is reaching “a tipping point” with regard to unconstrained development. “If we don’t protect the places people love, we are going to lose those places,” Wetmore told listeners.

Panel selects design, location for Robert Smalls memorial. A bipartisan legislative panel chose a design and location for the future Robert Smalls statue on the Capitol grounds, the first monument to an individual African American on the S.C. Statehouse grounds.

S.C. doctors ask federal court to throw out state’s abortion ban. Columbia obstetrician Dr. Patricia Seal and four other S.C. doctors laid out a legal complaint filed Jan. 8 that asked a federal court to throw out — or at least limit — the state’s abortion ban.

S.C. lawmakers fas- track school voucher bill. With hearings already complete, the state Senate plans to make a private school voucher bill its first big vote of 2025.

Senate GOP leader cites cost of dining out in S.C. Taxes on a restaurant meal in parts of South Carolina can run higher than rates paid in many of the United States’ largest cities, including Los Angeles and New York City, according to Senate Majority Leader Shane Massey, R-Edgefield.

S.C. legislators to discuss school bus conditions, teacher salaries. The “School Bus Privatization Act,” would place school bus selection and operation into the hands of individual school districts or private carriers instead of the South Carolina Department of Education. If passed, the bill would prohibit the state from owning or purchasing any additional school buses and its current fleet of buses would be disposed of starting in July.

S.C. environmentalists praise Biden’s offshore drilling ban. President Joe Biden took executive action this week to enact a ban on new offshore and gas drilling in most of the country’s coastal waters on 625 million acres of ocean. The ban includes the entire eastern seaboard, parts of the Gulf of Mexico and Alaska, as well as the coasts of California, Washington and Oregon. S.C. environmentalists said the ban would help to preserve the state’s special places.

S.C. starts scheduling executions again. The state Supreme Court set a Jan. 31 date for the next execution following a pause in scheduling for the holidays. Next to face death is Marcus Bowman Jr., 44, who was convicted of murder in the shooting of a friend in 2001 in Dorchester County.

Don’t sleep with your mouth open

Award-winning cartoonist Robert Ariail has a special knack for poking a little fun in just the right way. This week, he takes on the influx of people from outside of South Carolina with a funny – and kind of gross – cartoon that should make you laugh.

Love it or hate it? Did he go too far, or not far enough? Send your thoughts to feedback@statehousereport.com.

Focus on what’s real, not made-up politics

Commentary by Andy Brack | It’s beyond unfathomable that people are really talking about taking Greenland or Panama by force – and that others around the world are paying attention and responding with grave concerns.

Sure, when the future leader of the free world, President-elect Donald Trump, starts spewing nuttiness again about Greenland – and then throws in Panama for good measure – you probably need to pay attention, particularly when the United States has a huge nuclear arsenal in its back pocket.

Sure, when the future leader of the free world, President-elect Donald Trump, starts spewing nuttiness again about Greenland – and then throws in Panama for good measure – you probably need to pay attention, particularly when the United States has a huge nuclear arsenal in its back pocket.

But come on, really? This is nonsense – just another way for the narcissistic Trump to try to steal the limelight from real events that matter, from the terrible wildfires in California to war in Ukraine to the emotional state funeral for former President Jimmy Carter.

Instead of giving these issues and others their proper respect, we’re left with a political version of Seinfeld – big, old nothing-burgers. Perhaps that’s what’s ahead for four more years – emotional rollercoasters of political nothingness – not to make America great, but to lead the country into a downward spiral, just as Great Britain lost world power decades ago to become just plain old Britain.

Americans of all stripes should be outraged by this manufactured malarkey caused by intellectual laziness about what democracy actually is, the lack of appreciation for history and the unfettered algorithm that spews forth nonsense in the social media channels that addict Americans.

Even some solid conservative Republicans seem to be a little frustrated, as illustrated in recent days by a comment by S.C. Senate Majority Leader Shane Massey, R-Edgefield, after the squeaker of a vote to reelect U.S. Rep. Mike Johnson, R-Louisiana, as House Speaker. He wrote:

“The number of messages and emails I have received today from people complaining about me not voting for Rep. Mike Johnson for Speaker of the United State House of Representatives really … seriously … makes me question if there is even a basic understanding of civics (or spelling or geography) in this country. Please bring back Schoolhouse Rock!”

Massey also hit it out of the park this week by encouraging holistic tax reform, not just another round of income tax cuts being sought by the establishment. He said he believes sales and property taxes that fund local governments also need to be on the table, particularly when some local governments have passed measures so that taxes on prepared food at restaurants are higher here than in places like Los Angeles and New York City.

“In the name of home rule, we’ve let some localities go crazy,” Massey said, according to the S.C. Daily Gazette. “That has an impact on the business climate.”

A story this week in Statehouse Report highlights how some budgeting experts say the proposal to reduce South Carolina’s income tax is little more than a bait-and-switch to give the richest South Carolinians another tax cut to the detriment of regular taxpayers.

So yes, bring back more civics education in the form of the $50 million national campaign we called for in 2018 to teach people about the importance of free speech, the common good, democratic institutions and the rule of law.

Bring back common sense. Stop paying so much attention to the screen. Bring back thinking.

As GOP Sen. Larry Grooms, R-Berkeley, said in 2019: “All educated people should have an understanding of our founding documents and understand where individual rights come from and how those individual rights are exercised. If we ever lose sight of those, we’re back into mob rule.”

Embracing the rule of law, he said, “is something that conservatives and liberals should both embrace — the whole notion of a public discourse where you’re in the marketplace of ideas.”

Andy Brack is editor and publisher of the Charleston City Paper and Statehouse Report. Have a comment? Send to: feedback@statehousereport.com

Tips from S.C. on how to save Social Security

By Holley Ulbrich

CLEMSON, S.C. | Like many other states, South Carolina found itself in difficulty with its public pension system in the last two decades.

Years ago, the Social Security model of a defined- benefit pension program was widely adopted by states for their own public employees, but many of these state systems were underfunded. South Carolina’s underfunding resulted from a costly retirement incentive program and some serious errors in managing the funds. The 2000 dot.com crash and the 2008 housing crash took more bites out of the fund. Low pay for state workers and the availability of a 401(k) option for some state workers reduced the ratio of workers paying into the fund of retirees collecting benefits. Underfunding slowed down growth of revenue from the system’s assets even as payouts to retirees were rising.

But like at least a few other states, South Carolina has assumed its responsibilities to current and retired state workers. States like South Carolina increased the employee contribution by a moderate amount and the state contribution by a much larger amount until the system’s assets are at least close actuarially to being properly funded. In the last few years, the fund has actually seen revenue from pension fund contributions exceed payments to beneficiaries. Professional management, closely supervised by a commission with suitable professional qualifications, has made significant progress toward full- funding. South Carolina does not give cost-of-living adjustments (COLA), but it does provide an annual 1% increase, subject to a $500 cap.

Why am I writing to our U.S. senators about this issue? Because there are close parallels between what is happening in the states and the urgent need to take action on federal Social Security. Like South Carolina’s public pension plan, Social Security is a defined-benefit plan that is not adequately funded. But unlike the S.C. General Assembly, Congress has been all talk and no action. The only cap in Social Security is on the amount of wages and salary subject to the Social Security tax.

We should consider removing the federal cap on income subject to the tax and impose a cap on benefits instead. The average billionaire doesn’t derive much income from something as plebeian as wages and salaries, but rather from profits, dividends, capital gains and other forms of compensation that are not subject to Social Security taxes. So, they have no reason to object. Football coaches, university presidents and others might have a challenge rearranging their income streams to evade some of the tax, but it would still generate considerably more revenue.

Why do we also need a benefit cap? Part of the challenge of increasing the income cap subject to Social Security tax is that it would result in higher future benefits to be paid to those high-end workers, based on their full earnings. A second cap would be needed on benefits to make this proposal work. Most higher income earners have access to additional retirement income from pensions, 401(K) plans and investments. So a benefit cap would not be a serious challenge to their lifestyle.

Social Security was never meant to be the sole source of retirement income, although it is for many Americans. Right now, the maximum possible benefit for a single individual is about $6,000 a month, or $72,000 a year, which should enable someone to survive without depending on the local food bank. A benefit cap of $6,000 a month with an annual COLA should not be too much hardship to bear.

Married? A spouse with limited earnings can claim half her husband’s benefit, raising the family income from Social Security alone to as much as $108,000. (In the South Carolina retirement system, unlike Social Security, retirees can assure survivor benefits for a spouse only by reducing their own monthly benefit to ensure those payments.) Retirees on the lower end of the income spectrum receive a larger percentage of their average wage than wealthier retirees.

Benefits are also more favorable to households with a single high-earner than those relying on two earners, each with a more moderate income. Certainly there are other challenges to be addressed, such as treatment of two-income families, but time is wasting and the Social Security Trust Fund is shrinking. Let’s do something NOW to increase the revenue and slow the growth of future benefits.

Holley Ulbrich is an alumni distinguished professor emerita of economics at Clemson University.

Old white house

So here’s a picture of an old Datsun truck. Seriously, it’s an old white house that has some historical significance. What is that and where is the house? Send your name, hometown and guess to: feedback@statehousereport.com.

Our most recent mystery, “Gated community,” shows a brick gateway leading to the S.c. State Hospital, now the S.C. Department of Mental Health. “The photo’s historical significance,” Allan Peel of San Antonio, Texas, writes, “stems from the fact that the red-brick gateway leads to one of America’s first mental hospitals, originally called the ‘Lunatic Asylum State Hospital.’

Our most recent mystery, “Gated community,” shows a brick gateway leading to the S.c. State Hospital, now the S.C. Department of Mental Health. “The photo’s historical significance,” Allan Peel of San Antonio, Texas, writes, “stems from the fact that the red-brick gateway leads to one of America’s first mental hospitals, originally called the ‘Lunatic Asylum State Hospital.’

“It was founded and created by an act of the General Assembly in 1821, but it took more than seven years before it finally opened its doors and accepted its first patient in December 1828. The asylum was conceived as a place of refuge and treatment for the mentally ill, and while it did not always live up to its founders’ hopes, it was South Carolina’s first foray into charitable institutions.”

Others who correctly identified the photo were: Jay Altman and Elizabeth Jones, both of Columbia; George Graf of Palmyra, Va.; Curtis Joyner of Charleston; David Lupo of Mount Pleasant; Jane Hart Lewis of Florence County; and Jacie Godfrey of Florence.

- Send us a mystery picture. If you have a photo that you believe will stump readers, send it along (but make sure to tell us what it is because it may stump us too!) Send to: feedback@statehousereport.com and mark it as a photo submission. Thanks.

Column on state priorities is reasonable

To the editor:

![]() I just finished reading your article about the state’s priorities. I believe they are reasonable goals that will most likely be ignored. I know I am a cynic but I have been around government from local to federal most of my life and the will to do good is weak.

I just finished reading your article about the state’s priorities. I believe they are reasonable goals that will most likely be ignored. I know I am a cynic but I have been around government from local to federal most of my life and the will to do good is weak.

One additional priority I would like to see added is strengthening local and state ethics and lobbying laws. South Carolina has some of the weakest laws in the nation and that is not good for the citizens of this state.

– Mike Kirby, Ladys Island, S.C.

Well-done piece on tax cuts

To the editor:

I found “Proposed state tax cuts could be bait-and-switch, experts suggest” by Jack O’Toole to be an exceptionally well-done piece in an area that deadens the brain. I would like to know more about the sales tax behaviors.

I am like Sen. [Shane] Massey, who finds his dining-out tax too high. Tax rate surprises on the receipts of other transactions provoke disdain. A breakdown of transaction counts and total revenue collected by each tax percentage category could help me understand how many pay how much, especially at the lower transaction price where it is possible to infer better the actual impact on lower-income families. Pushing the tax onto minority lower-income families is easy. This is not a benign tax for them (and Sen. Massey).

Further, sales taxes are an inefficient, expensive source of capital funding. S.C. localities use the incremental sales tax add-on matter-of-factly at the local level, while the state uses other models. Chambers of commerce seem to prefer the sales tax as they did in the 2024 referendum. Even “rich” Charleston County could use debentures but went mostly with the sales tax in the 2024 referendum, partly to capture “visitor” sources.

If the county-level breakdown of sales tax transaction counts and total revenue collected by each tax percentage category were made available from the S.C. Dept of Revenue, we could clearly understand what a “less harmless” local add-on does that probably varies significantly by locality. Some localities are not candidates for add-on sales taxes as their local economies lack sufficient transaction variety. And part of explaining the shrinkage of some S.C .counties lacking funds for local infrastructure (my theory). “And they eventually have to pay for that with something — usually raising or expanding sales taxes and fees or kicking responsibilities down to the locals, all of which ask more of lower- and middle-income families.”

– Fred Palm, Edisto Island, S.C.

Send us your thoughts

We encourage you to send in your thoughts about policy and politics impacting South Carolina. We’ve gotten some letters in the last few weeks – some positive, others nasty. We print non-defamatory comments, but unless you provide your contact information – name and hometown, plus a phone number used only by us for verification – we can’t publish your thoughts.

-

- Have a comment? Send your letters or comments to: feedback@statehousereport.com. Make sure to provide your contact details (name, hometown and phone number for verification. Letters are limited to 150 words.

ABOUT STATEHOUSE REPORT

Statehouse Report, founded in 2001 as a weekly legislative forecast that informs readers about what is going to happen in South Carolina politics and policy, is provided to you at no charge every Friday.

- Editor and publisher: Andy Brack, 843.670.3996

- Statehouse bureau chief: Jack O’Toole

Donate today

We’re proud to offer Statehouse Report for free. For more than a dozen years, we’ve been the go-to place for insightful independent policy and political news and views in the Palmetto State. And we love it as much as you do.

But now, we can use your help. If you’ve been thinking of contributing to Statehouse Report over the years, now would be a great time to contribute as we deal with the crisis. In advance, thank you.

More

-

- Mailing address: Send inquiries by mail to: P.O. Box 21942, Charleston, SC 29413

- Subscriptions are free: Click to subscribe.

- We hope you’ll keep receiving the great news and information from Statehouse Report, but if you need to unsubscribe, go to the bottom of the weekly email issue and follow the instructions.

- Read our sister publication: Charleston City Paper (every Friday in print; Every day online)

- © 2025, Statehouse Report, a publication of City Paper Publishing, LLC. All rights reserved.