By Andy Brack | The S.C. General Assembly failed again in 2023 to enact real tax reform to make the funding of state government fairer and more equitable.

It’s a shame. They’ve only had decades to do it. Years back, before Gov. Mark Sanford hopped around on the Appalachian Trail, he pushed for comprehensive tax reform to balance the tax code, but all that happened was a big, thick report that still sits on a shelf somewhere. Other efforts also have failed.

It was also on Sanford’s watch that the legislature got hoodwinked into passing Act 388 in the name of property tax relief for homeowners. But it ended up exacerbating problems with the tax code by shoving the burden of school funding into the regressive sales tax and away from residential property owners. Guess who suffered? Renters, commercial property owners and lower- and middle-class residents, who pay a higher percentage of their income in sales taxes than others.

So even though what we pay in taxes is the biggest thing legislators deal with year in, year out, they continue to ignore inequities and regressivity in the state tax code. Translated, that means you’re likely paying way more than you should when you consider your total tax burden. Who’s not getting shafted? Yep, the rich folk.

Here’s the skinny on South Carolina’s tax structure:

Sales tax. The state has a 6% sales tax rate, but local governments can impose up to 3% more—meaning that you generally pay about 9% in sales taxes. The average in South Carolina is 7.43%, according to the Tax Foundation. Note: South Carolina also offers dozens of sales tax exemptions through its tax code, which means the state doesn’t generate more than $2 billion in revenue every year because it says businesses and individuals don’t have to pay sales taxes on exempted goods and services. Doling out exemptions is very political.

Income tax. About half of South Carolinians pay no income tax, due to their earnings. The top rate is 6.5%, but that’s been dropping slightly in recent years as legislators nibbled the income tax rate down. Interestingly, income tax tends to be progressive – meaning that it impacts richer folks more than those who are poorer. This has tended to offset the burden of sales taxes on those with less money. But by lowering income taxes, the Republican-controlled legislature is really doing little more than shifting the overall tax burden again—away from those with more money.

Property taxes. These are set by local governments. But remember, the old residential property taxes on schools were replaced with the burden-shifting sales tax through Act 388.

User fees. About a quarter of the state’s revenues comes in various licenses, tickets, user fees and more. This pool of money has been increasing over the years.

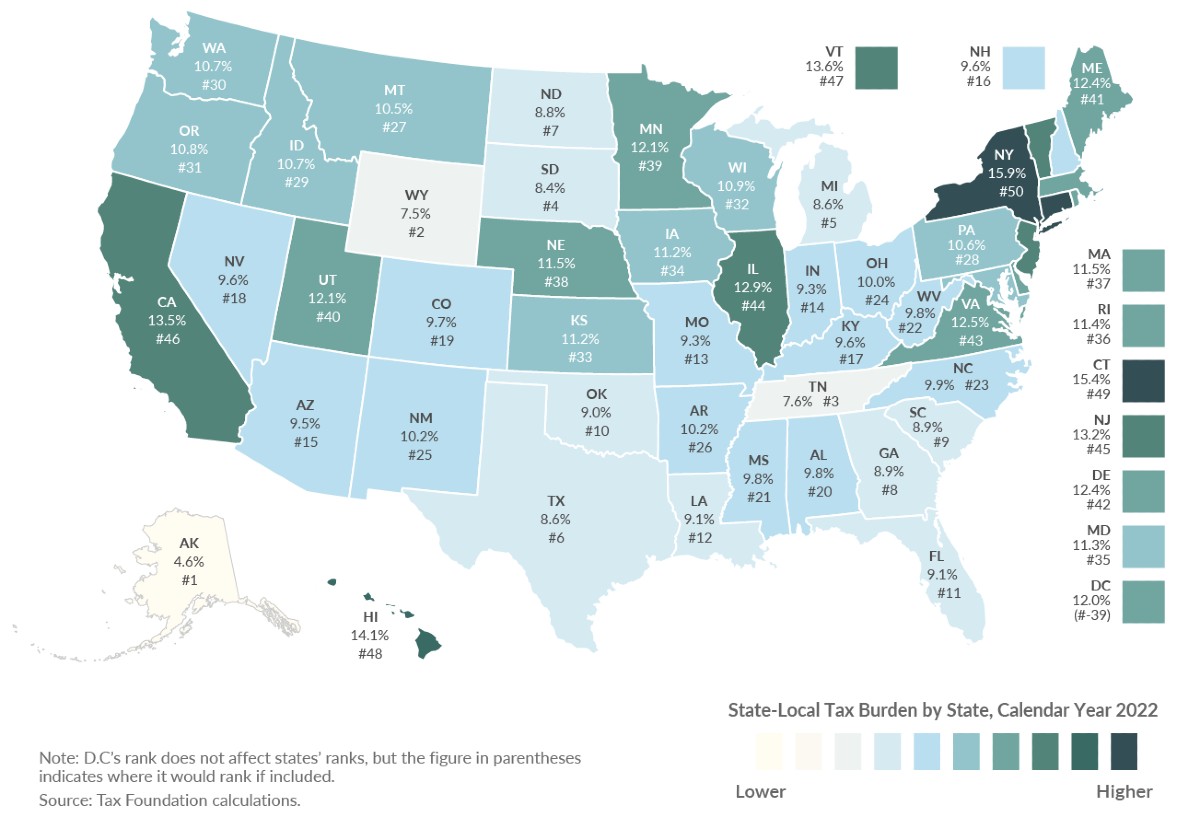

When you blend local and state taxes to try to figure out how much they hurt, you actually find that South Carolina has the 9th lowest state-local tax burden with 8.9% of income on average going taxes. But its sales tax burden is 18th highest, which reflects inequities in the system.

So what’s the legislature to do? Here are three things it could do to make South Carolina’s tax structure fairer:

- Repeal Act 388 and restore equity to the school funding system.

- Review and modernize billions of dollars of sales tax exemptions.

- Shift $1 billion in savings from modernizing exemptions to cut the sales tax by at least a penny.

It’s time for the legislature to do the hard work on the state tax code to make it better for everyone. Right now, it’s tilted against most people.

Award-winning columnist Andy Brack is editor and publisher of Statehouse Report and the Charleston City Paper. Have a comment? Send to: feedback@statehousereport.com.