Staff reports | The state’s annual weekend-long sales tax holiday kicks off Aug. 6 and runs through Aug. 8 — a three-day period during which shoppers are able to buy certain items in South Carolina stores, both online and in stores, without paying a 6 percent state sales tax and applicable local taxes.

Among the items that can be purchased are school supplies, clothing, footwear, computers, musical instruments and outerwear. Not eligible for the exemption are eyewear, furniture, cell phones and office supplies. For a full list of sales tax-free items, check out the state’s full guide to the tax holiday.

Weekend to save some

After a tough year for businesses with COVID-19 restrictions in place and many consumers feeling uncertain of their employment status, state officials say the tax-free weekend is a welcomed event and great opportunity for shoppers to support local businesses and their communities.

“Tax Free Weekend is a great way for South Carolina shoppers to save money, and it’s also a great way to demonstrate our support of South Carolina businesses who have struggled this past year,” said S.C. Department of Revenue Director Hartley Powell in a press release.

According to the agency, last year’s sales tax weekend resulted in the sale of more than $18.1 million in eligible items.

But also a “political gimmick”

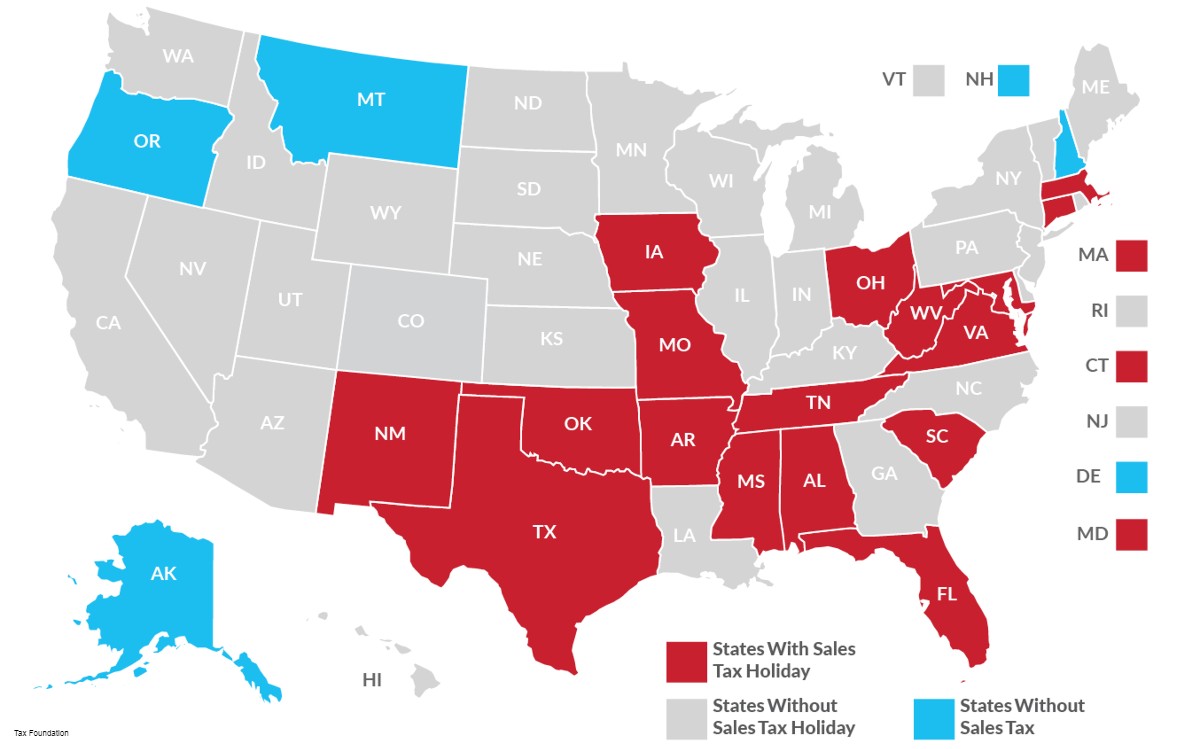

While proponents laud the weekend for promoting economic growth, the data isn’t as convincing, according to the nonpartisan Tax Foundation:

“The evidence (including a 2017 study by Federal Reserve researchers) shows that, instead of increasing purchases, consumers simply shift the timing of purchases they were already going to make. For most who shop during sales tax holidays, the exemptions simply provide a modest and unexpected benefit for doing something they would have done anyway.”

What sales tax holidays really do, the organization says, is to mislead consumers about savings. Low-income groups may get some savings, but higher-income groups get more.

The organization concludes, “Sales tax holidays are political gimmicks that distract from genuine, permanent tax relief. If a state must offer a ‘holiday’ from its tax system, it is an implicit recognition that the tax system is uncompetitive. If policymakers want to save money for consumers, they should work to reduce the sales tax rate year-round.”

Samantha Connors of the Charleston City Paper contributed to this story. Have a comment? Send to feedback@statehousereport.com