NEWS: With education in sights, lawmakers predict sluggish start to session

BRIEFS: S.C.-ya later SCE&G, tax climate, higher ed and more

COMMENTARY, Brack: Don’t play verbal shell games on fair tax reform

SPOTLIGHT: Riley Institute at Furman University

FEEDBACK: Voting machines should be on priority list

MYSTERY PHOTO: Another building with an interesting shape

S.C. ENCYCLOPEDIA: Coker College

BIRTHDAY: Happy birthday to us as we start our 18th year of publication today!

NEWS: With education in sights, lawmakers predict sluggish start to session

By Lindsay Street, Statehouse correspondent | When the legislative session begins Jan. 8, lawmakers will begin grinding the two-year session’s primary targets — education and tax reform — through subcommittees and committees.

It’ll look like a sluggish start with mostly non-controversial bills or past bills that gained traction but didn’t have enough steam last session, according to House and Senate members.

“Things will take a little while and move slowly in the beginning,” said S.C. Senate Majority Leader Shane Massey, R-Edgefield.

Legislation that could be brought to the floor early in 2019 includes bills to address gubernatorial appointments made when the General Assembly isn’t meeting, medical marijuana, local government funding, and additional measures to curb opioid abuse, according to elected leaders and staff members.

Likely first moves

The S.C. House of Representatives has already organized during the off-session, but for the Senate, that will be a first priority. There, the Senate is expected to reorganize under a president of the Senate now that the state’s lieutenant governor is no longer the chamber’s presiding officer. .

After organizing, the Senate is likely to address out-of-session gubernatorial appointments, insiders said

“What you’ll see is that the Senate is going to pass pretty quickly to fix the interim appointments issue that came up in the fall,” Massey said. During recess, Gov. Henry McMaster appointed former S.C. Attorney General Charles Condon as interim chairman of state-owned utility Santee Cooper. The Senate, which confirms gubernatorial appointments, objected to the move but later lost a suit in court.

Meanwhile, the House is expected to begin committee work in earnest, especially in the budget-writing Ways and Means Committee. The annual state budget originates in the House.

New Ways and Means Chairman Murrell Smith, R-Sumter, said education and its funding will be tackled early in the committee’s legislative and budget-writing subcommittees.

“You’re going to see a lot of emphasis on that both on the policy-side and the funding-side,” Smith told Statehouse Report.

During the second week of session, Jan. 14-18, the Senate isn’t expected to convene as a full body, but will address items in committee that week, sources said.

“The Senate is going into perfunctory session to allow us to work in committees,” Sen. Sean Bennett, R-Dorchester, said. “That could generate results pretty quickly.”

The bills to move quickest at the beginning of session “aren’t very life changing” and wouldn’t “cure cancer,” according to Bennett. But Davis, his Republican colleague from Beaufort, said he hoped his medical marijuana-focused bill will go early to the floor.

A few early favorites

Medical marijuana has been controversial in past sessions, but Davis said he thinks the bill has finally come into maturity and will be an easy pass.

“I’m optimistic that 2019 is the year where we get a tightly controlled, conservative medical marijuana bill passed,” Davis told Statehouse Report. “It’s taken a while for us to get it exactly right.”

Davis said he is working with Rep. Peter McCoy, the Charleston Republican who is new chair of the House Judiciary Committee. They will work similar bills in both bodies, Davis said.

But House Majority Leader Gary Simrill had his doubts that controversy is finished with medical marijuana. He said the House will work “methodically” on education reform, and when asked what bills were likely to make it to the floor early in session, Simrill replied:

“I don’t look at it as a race like that. It’s all encompassing. When you deal with education reform there’s both a funding component that goes along with a formative change component.”

House leaders also appear poised to tackle issues that gained positive traction last session only to die in the Senate or get pushed aside.

House Speaker Pro Tempore Tommy Pope, R-York, said he’s hopeful further opioid legislation will push through, along with a state anti-terrorism bill that would stiffen state penalties against would-be terrorists.

Smith said Ways and Means could move quickly on a local government funding bill that was stalled last session. The bill seeks to add money to local governments’ current allotment, which is below the statutory funding level, freeze it and then allow the allotment to grow or decrease in correspondence with the budget.

House Minority Leader Todd Rutherford, D-Richland, said the legislature will also have to act quickly on criminal justice reform, following reform on the federal level.

Rutherford and Davis both predicted energy policy moving quickly early on, too. Davis, who has been pushing for “breaking up of energy monopolies,” said energy reform has become a “Venn diagram” for fair market conservatives, alternative energy proponents, and environmentalists — making a potential controversial topic easier to pass earlier in the session.

- Have a comment? Send to: feedback@statehousereport.com

NEWS BRIEFS

BRIEFS: S.C.-ya later SCE&G, tax climate, higher ed and more

By Lindsay Street, Statehouse correspondent | South Carolina Electric and Gas (SCE&G) is becoming Dominion Energy now that the utility’s sale officially finalized Wednesday.

About 730,000 electric customers in the state now will get power through the Virginia-based utility. The buyout brings several entities of the Cayce-based SCANA (SCE&G, SCANA Energy in Georgia and PSNC Energy in Georgia) and their roughly 5,200 employees under Dominion Energy now. But if you’re still getting correspondence from SCE&G, the brand name soon will catch up with the sale. It may take up to six months for the SCE&G brand to shift to Dominion, according to a spokesperson … from SCE&G.

For 17 months, SCE&G has floundered for its majority stakeholder role in the fallout of a shuttered $9 billion nuclear project, drawing lawsuits and ire from lawmakers.

As part of the purchase deal, the utility will continue to collect $2.3 billion from ratepayers toward the unfinished nuclear reactors over the next two decades and power prices will remain unchanged for customers, permanently locking in the rate cut ordered by the legislature at the end of last session. Read more here.

In other news items this week:

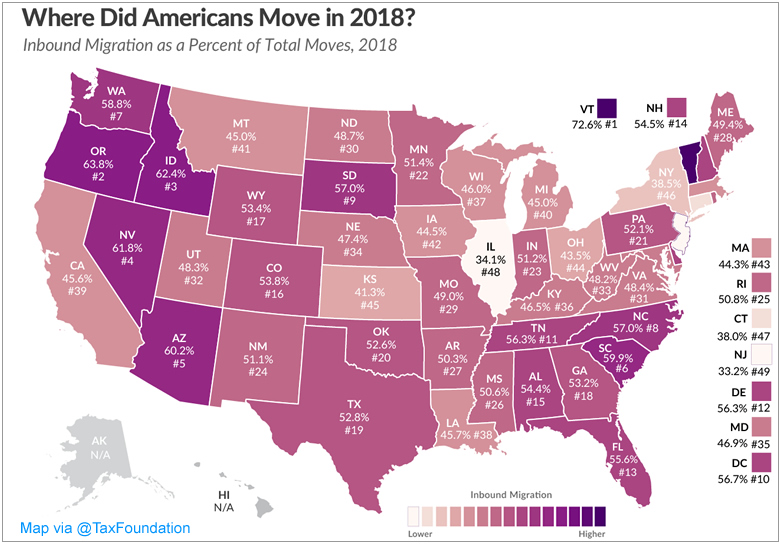

S.C. is hot despite tax climate. Five of the 10 worst-performing states on the Tax Foundation’s State Business Tax Climate Index are also among the 10 states with the most outbound migration in this year’s National Movers Study. But South Carolina bucked that trend — probably because of its palmetto trees, sunsets and hospitality. South Carolina was ranked 35 (in a list where you want to be No. 1, putting it in the bottom 15 of states) for its business tax climate, and yet is No. 6 for inbound migration. More info.

College watchdog gets new head. The S.C. Commission on Higher Education has tapped Michael LeFever to serve as interim president and executive director. At the tail end of 2018, CHE’s President and Executive Director Jeff Schilz resigned after lawmakers questioned the legitimacy of a $91,500 pay raise by the CHE board. He was the second official to resign after the misstep. LeFever is the former president and CEO of South Carolina Independent Colleges and Universities. He has served as the director of four different state agencies including 13 years as the executive director of the Workers’ Compensation Commission and as deputy chief of staff for Executive Office Programs and Cabinet Affairs in the administration of Gov. Jim Hodges.

Big data breach back in news. About 6 million South Carolinians had their data exposed in 2013 to hackers. Since that time, South Carolina has tried to adopt industry standards for centralizing security rules for the state’s 100-plus agencies, but a system on checking whether those agencies have those protections in place is still in the works. Read more here.

Clean energy group mobilizing. A coalition of solar industry groups, conservation organizations and clean energy advocates announced this week a 100 Day Clean Energy Agenda, calling on state lawmakers to pass a suite of policies in the first 100 days of 2019 that will inject competition into South Carolina’s energy sector. The campaign reportedly will include over 750,000 contacts across key legislative districts in every region of the state to stress the need for legislative action by April 10 – the 100th day of 2019. The coalition (click here to see who they are) is promoting: elimination of the net metering cap for residential solar, fair and transparent rates for both residential and large-scale solar, allowances for businesses to contract directly with independent clean power providers, and encouragement of solar accessibility to all South Carolinians, regardless of income. Lowcountry Republicans Rep. Peter McCoy of James Island and Sen. Tom Davis of Beaufort are part of the coalition.

Flu is everywhere in S.C. (And that includes this correspondent.) The S.C. Department of Health and Environmental Control and the federal Centers for Disease Control and Prevention are reporting increases in flu in the state — specifically for the Lowcountry and Midlands. Wash those hands, cover that cough, get a flu shot (if you’re inclined), and eat an orange. It may not help, but at least you tried.

Looking ahead

Click below for other items coming up in the Statehouse:

- House calendar

- Senate calendar

- Have a comment? Send to: feedback@statehousereport.com

BRACK: Don’t play verbal shell games on fair tax reform

By Andy Brack, editor and publisher | Two people can look at a painting or watch the same football game and see two completely different things.

One person, for example, might see little more than an abstracted bull, horse and people in Picasso’s Guernica. Another might be moved to tears over human suffering.

One person, for example, might see little more than an abstracted bull, horse and people in Picasso’s Guernica. Another might be moved to tears over human suffering.

A fan of one team on the gridiron might see a team experiencing a crushing loss. A supporter of the opposing team might tell friends he’d witnessed the best football game ever.

How one views an event or a painting or an issue of public policy is often a matter of perspective.

With this in mind, let’s look to an issue sure to rear its head throughout the coming session of the South Carolina General Assembly: Tax reform.

When people start talking about tax reform, most think it’s a good idea. They generally don’t like taxes, or the cost that one pays to fuel government services that most people want. But they do want to reform that system so that they feel like they’re getting more for their money or making a better investment with their tax dollars.

Real tax reform is more complicated because it’s a matter of perspective.

The state Chamber of Commerce Foundation, which commissioned a big report on how to overhaul South Carolina’s complicated tax structure, is pushing for reform that essentially will broaden the tax base and lower rates – a concept that economists roundly endorse as making good fiscal and structural sense.

The phrase “broadening the base,” however, means more things could be taxed. In South Carolina, for example, few professional services, such as legal fees, are subject to sales tax. A “reform” of how these services are taxed could make people who use lawyers pay more in taxes. But broadening who pays could ultimately lower the rate, which could help even more people.

Similarly, look at the billions of dollars the state doesn’t collect annually due to sales tax exemptions. For people who have been subsidizing a special-interest exemption, removing it might seem fair because they would no longer pay for it. But the folks benefiting from the exemption wouldn’t be happy because they’d have to pay more in sales taxes.

Yes, it’s complicated. But for lots of taxpayers, this notion of fairness is central to comprehensive tax reform. They want to make sure the burden of state taxes they’re shouldering is fair compared to everyone else. They don’t want to pay a higher portion of taxes than someone who is rich.

This sense of tax fairness or equity came up time and again in dozens of comments to a recent Statehouse Report reader survey. When asked to explain what tax reform means to them, here are some reader responses:

“Logically fair tax rates and distribution of tax revenues,” said Michele Barker of Beaufort.

“Fair distribution of paying responsibility to include rethinking tax breaks for corporations,” responded Jennifer Reed of Columbia.

“Tax reform to me means equality,” said William Spearman of Summerville. “No loopholes, no favored business sectors, etc. And I believe the poorest should not be taxed excessively.”

Another reader: “Everyone pays their fair share, including the wealthy, so the middle class does not bear the greatest burden.”

But comments also show how the notion of fairness can be squishy. Reform, one person said, meant fairness, but also higher taxes for the rich.

Few legislators answered a similar survey. But those who did, most of whom were Republican, offered a different notion of comprehensive tax reform. Rather than something based solely on fairness with strategies of broadening the base and lowering rates, they mentioned something else – tax neutrality. They viewed reform as rearranging taxing structures while keeping state revenues the same.

Unfortunately, that adds a level of complexity to everything. It would be difficult to treat everyone fairly and broaden a base to make it more structurally sound. Reforming structures in a revenue-neutral way likely would create shifts from one group to another.

South Carolina legislators need to revamp the antiquated tax structure. But they need talk honesty and candidly about tax restructuring that will be fairest to all. Otherwise, they will be playing a verbal shell game, dooming real tax reform yet again.

- Have a comment? Send to: feedback@statehousereport.com.

SPOTLIGHT: Riley Institute at Furman University

The public spiritedness of our underwriters allows us to bring Statehouse Report to you at no cost. This week’s spotlighted underwriter is The Richard W. Riley Institute of Government, Politics, and Public Leadership, a multi-faceted, non-partisan institute affiliated with the Department of Political Science at Furman University.

The public spiritedness of our underwriters allows us to bring Statehouse Report to you at no cost. This week’s spotlighted underwriter is The Richard W. Riley Institute of Government, Politics, and Public Leadership, a multi-faceted, non-partisan institute affiliated with the Department of Political Science at Furman University.

On Jan. 8, the Riley Institute hosts the 14th annual Wilkins Awards Dinner to honor legislators and civic leaders. A reception begins at 6 p.m. at the Columbia Metropolitan Convention Center with dinner an hour later. This year’s award winners are state Sen. John Matthews, D-Orangeburg, and civic leader Charlotte Berry of Columbia.

- Want to attend? Get your tickets here.

Named for former Governor of South Carolina and United States Secretary of Education, Richard Riley, the Riley Institute is unique in the United States in the emphasis it places on engaging students in the various arenas of politics, public policy, and public leadership.

- Learn more about the Riley Institute.

- Also learn more about the Riley Institute’s Center for Education Policy and Leadership.

FEEDBACK

FEEDBACK: Add voting machines to priorities

To the editor:

![]() I’m sorry not to see new voting machines — ones that preserve a paper trail – on your list [12/28: Palmetto Priorities].

I’m sorry not to see new voting machines — ones that preserve a paper trail – on your list [12/28: Palmetto Priorities].

That really must be done this year and to do it right will require a Blue Ribbon Committee to study what’s available and make recommendations quickly. Such a committee can bypass the General Assembly’s tendency to defer the difficult choices until the final days and they can educate the public so that we all can insist that this is not lost in the confusion again this year.

— Mimi Dias, Charleston, S.C.

Send us your thoughts … or rants

We love hearing from our readers and encourage you to share your opinions. But you’ve got to provide us with contact information so we can verify your letters. Letters to the editor are published weekly. We reserve the right to edit for length and clarity. Comments are limited to 250 words or less. Please include your name and contact information.

- Send your letters or comments to: feedback@statehousereport.com

MYSTERY PHOTO: Another building with interesting shape

Here’s another building with a rounded shape. But is it a castle in South Carolina? What is it? Send your guess to feedback@statehousereport.com. And don’t forget to include your name and the town in which you live.

Our previous Mystery Photo

Our Dec. 28 mystery, “Building with interesting shape,” shows the rear of Davidson Hall at Coker College in Hartsville.

Our Dec. 28 mystery, “Building with interesting shape,” shows the rear of Davidson Hall at Coker College in Hartsville.

Congratulations to these photo detectives: Lexie Chatham of West Columbia; George Graf of Palmyra, Va.; Frank Bouknight of Summerville; David Taylor of Darlington (who had help from his wife!); and Jay Altman of Columbia.

Graf sent this context: “According to nationalregister.sc.gov, Davidson Hall, located on the campus of Coker College, was constructed about 1909-1910, with funds donated by the college’s founder, (Confederate) Major James Lide Coker. Major Coker, noted Hartsville industrialist, merchant, banker and agriculturalist, founded Coker College to provide quality education for women and to extend cultural opportunities to the Pee Dee region.

“Davidson Hall is significant for its association with Major Coker’s philanthropy and it is important in the history of education in the Pee Dee. It was the first building constructed for Coker College and it became the symbol of the school; its façade is incorporated into the college seal.

“Designed by the prominent South Carolina firm of Wilson, Sompayrac, and Urquhart, the two-story, brick educational building is enhanced by Neo-Classical details and stands out as one of Hartsville’s finest buildings. The hall is a rectangular plan brick building laid in common bond. It has a hip roof and a projecting semicircular auditorium on the rear elevation. The central portion of the fifteen bay façade features a projecting, two-story, pedimented portico, which is supported by six stuccoed Ionic columns with scamozzi capitals. A cornice embellished with dentil molding encircles the entire building. Listed in the National Register Nov.10, 1983.”

Send us a mystery: If you have a photo that you believe will stump readers, send it along (but make sure to tell us what it is because it may stump us too!) Send to: feedback@statehousereport.com and mark it as a photo submission. Thanks.

S.C. ENCYCLOPEDIA

HISTORY: Coker College

S.C. Encyclopedia | Founded in 1908, Coker College is an independent liberal arts college located in Hartsville. Named for Major James Lide Coker, the college is the product of his philanthropic efforts to improve the state’s educational opportunities. This work began with the establishment of Welsh Neck High School in 1894. In 1907 the creation of a statewide public high school system alleviated the need for private high schools, and Coker embraced the opportunity to convert the high school into a women’s college. Thus, Coker College was born. The burgeoning business enterprises of the Coker family provided funds to support the new institution. Major Coker donated $25,000 for the construction of an administration building in 1909; $150,000 for the college’s endowment in 1910; and $65,000 for a one-hundred-bed dormitory in 1914.

At the start of the twentieth century, the college maintained its Christian nondenominational roots. The earliest catalog noted that “no attempt whatsoever to influence pupils in their denominational preferences will be made or tolerated.” Major Coker believed that education, rather than religion, was the primary purpose of higher education. In 1944 the college broke its ties to the Baptist Association and reorganized its self-perpetuating board.

After Coker’s death in 1918, his heirs ensured his legacy. Successive generations funded construction, including the library (1962), the student center (1971), and a performing arts center (1997). Kalmia Gardens, a thirty-acre nature preserve, was donated to the college in 1965. Perhaps most telling of the family’s contributions to the college is that prior to 1969 all college facilities were built without debt.

Despite challenges, Coker College held on to its roots in the liberal arts. In 1929 a $400,000 endowment campaign was wiped away by the stock market crash. Enrollment wavered; the board authorized new course offerings to include business administration and “areas of vocational and professional demand.” In the years following World War II, returning veterans enrolled. Officially, the college became coeducational in 1969, and the first men enrolled in 1970. Under a mandate by the Civil Rights Act, the college opened its doors to minorities, and the first African American female enrolled in 1968. The 1960s also witnessed increasing competition from Winthrop College in Rock Hill. In order to remain competitive, Coker instituted several programs designed to broaden the college’s reach and income. The Military Degree Completion Program was instituted in 1970 to assist National Guardsmen and, later, soldiers stationed at Fort Jackson with college course work. The college also agreed to house the Governor’s School for Science and Mathematics, thus utilizing college facilities and serving statewide needs.

In 2000 Coker’s on-campus enrollment of more than four hundred was drawn by its solid reputation, as noted by U.S. News & World Report and Barron’s college reviews. Such distinctions were gleaned from Coker’s “round table” teaching style, as most classes were taught around large tables, thus fostering classroom dialogue. Many classes had fewer than twelve students, and eighty-five percent of the faculty held the highest degrees in their fields. The student population was seventy percent female and approximately twenty percent African American.

— Excerpted from an entry by Julie Rotholz. This entry hasn’t been updated since 2006. To read more about this or 2,000 other entries about South Carolina, check out The South Carolina Encyclopedia, published in 2006 by USC Press. (Information used by permission.)

ABOUT STATEHOUSE REPORT

Statehouse Report, founded in 2001 as a weekly legislative forecast that informs readers about what is going to happen in South Carolina politics and policy, is provided to you at no charge every Friday.

- Editor and publisher: Andy Brack, 843.670.3996

- Statehouse correspondent: Lindsay Street

More

- Mailing address: Send inquiries by mail to: P.O. Box 22261, Charleston, SC 29407

- Subscriptions are free: Click to subscribe.

- We hope you’ll keep receiving the great news and information from Statehouse Report, but if you need to unsubscribe, go to the bottom of the weekly email issue and follow the instructions.

- © 2019, Statehouse Report. All rights reserved.