By Lindsay Street, Statehouse correspondent | Tens of millions of state revenues hang in the balance depending on whether the General Assembly runs out the legislative clock on updating the state’s tax code to fall in line with the federal tax code.

Just about everybody at the Statehouse agrees it’s complicated. (It is about income taxes, wags say.) But what leaders can’t agree on at this point is what to do about the tax mess brought on after Congress overhauled the federal tax code late last year.

That dramatic income tax reform eliminated many federal deductions and exemptions. Now if the state doesn’t take action to account for the federal changes, South Carolina would receive a few million dollars more in income tax revenue but, by default, create a duplicative tax system that would likely be a nightmare to tax filers.

Meanwhile if legislators decide to conform to federal reform without making major changes to the state’s tax code, South Carolina could generate a whopping $200 million in extra revenue — which critics say is an underhanded tax hike not in the spirit of the federal reform. Yet another option would be for the state to conform to the federal code and make changes to the state’s tax code to offset the extra revenue through strategies like potentially restoring some deductions lost in federal reform

To add another layer of complexity on the whole mess: Doing nothing, while confusing, actually might give lawmakers a better chance at sweeping and comprehensive tax reform that would broaden and flatten the overall tax base to make it fair for years to come.

Background

South Carolina is one of many states that keeps its tax code in line with the federal government. Once a taxpayer has completed his or her federal taxes, he or she can use that as a baseline to begin the state’s paperwork. The parallelling of the state code to the federal code is called “conformity,” and it’s up to the legislature to keep the code updated year to year.

![]() But the massive tax overhaul in 2017 eliminated many deductions and exemptions on the federal level, and simply conforming would result in a tax increase, according to state researchers.

But the massive tax overhaul in 2017 eliminated many deductions and exemptions on the federal level, and simply conforming would result in a tax increase, according to state researchers.

Conforming without altering the state’s tax code would mean an even bigger tax increase: $205 million, according to the S.C. Revenue and Fiscal Affairs Office (RFA).

The House passed a bill for conformity that offers minor alterations designed to keep the state from raising revenue. The Senate is mulling another bill that also offers similar alterations to the tax code. Conformity is one of the post-session goals of the General Assembly and could be hashed out in the two-day session June 27 and 28.

Business leaders across the state and House leadership are pushing for conformity, and the S.C. Republican Party will ask voters during the June 12 primary whether the state’s tax code should align with the new Trump tax code.

But, in an attempt to enact bigger tax reform, the Senate could hold out, according to a Senate Finance Committee member.

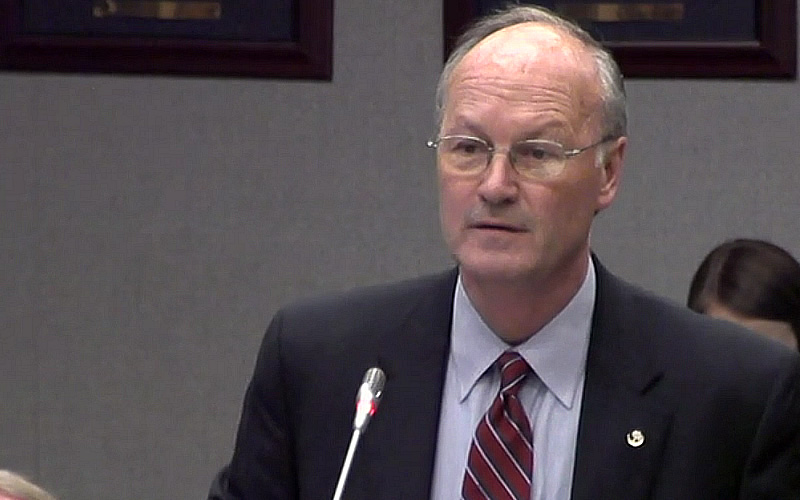

“I’m not going to let the ease of implementation drive a good or bad policy decision going forward because a policy decision is going to have positive or negative impacts for decades to come,” Dorchester Republican Sean Bennett told Statehouse Report. “When you rush into these decisions like this, it’s fraught with disaster or missed opportunity at least.”

But waiting to conform also has consequences.

Various options fraught with complications

Without aligning the state tax code to the federal code (called nonconformity), the state will see nearly $12 million in additional revenue due to certain sunsetted exemptions, according to the RFA’s April testimony to a House panel. That tax increase begins for this filing year and would continue for each year that the state remains out of step with the federal government’s tax code.

Noncomformity also has other issues, even in the short-term. South Carolina Association of CPAs board member Ken Newhouse said there is a lot of uncertainty and undue burden with nonconformity.

Noncomformity also has other issues, even in the short-term. South Carolina Association of CPAs board member Ken Newhouse said there is a lot of uncertainty and undue burden with nonconformity.

“(Nonconformity) significantly raises the cost of administration and burden for people to be able to interpret it and could result in more lawsuits,” Newhouse said. The SCACPA intends to lobby lawmakers and push for conformity.

Tax preparers, who will need to have working knowledge of two different codes, may also increase fees by as much as 200 percent as they encountered a complex filing system, Newhouse said.

That could lead to two things: decreased compliance from taxpayers and businesses left in limbo on the best tax decisions to make. Both could wallop the state’s tax base.

If the compliance rate drops by just one percent, it could cost the state $45 million in the 2019-20 budget, according to RFA Executive Director Frank Rainwater, who spoke to House budget writers in April. Though it is likely to affect taxpayer compliance, it’s unknown how many taxpayers will balk, he added.

Further, S.C. Department of Revenue Director Hartley Powell also testified nonconformity could result in “a chilling effect” for the state’s red-hot economy.

Political will

The GOP is asking voters in its June 12 primary how lawmakers should respond — possibly lighting a fire under legislators to act in the June 27 and 28 session, which is expected to be devoted to the state’s annual spending budget.

Bennett said he’s not certain the Senate will be convinced to act, however. He said was “surprised” when Senate Finance Chair Hugh Leatherman dropped a conformity bill in the last days of session. He said his prior conversations with the high-ranking Republican led him to believe that the Senate would delay any conformity conversation until next session.

“More broadly discussed in the Senate was not conforming,” Bennett said. “Our view was that we weren’t going to conform during the current legislative year because there are a lot of moving parts to conformity … This conformity discussion lends itself to a larger tax policy discussion on ways to improve our current tax policy.”

Bennett called conforming quickly and without meaningful tax reform “wrong-headed,” adding he could not think of a single senator who is in favor of conforming in June, with the exception of Leatherman.

“The Senate is not inclined,” Bennett said. He added that he would like to study the issue and come back ready for conformity and tax reform in January.

Leatherman’s office did not respond to calls requesting comment. House Speaker Jay Lucas’ handler Caroline Delleney also did not respond to a call requesting comment for this story.

- Related: Minnesota moving toward nonconformity with Democratic governor’s veto.

- Have a comment? Send to: feedback@statehousereport.com