By Lindsay Street, Statehouse correspondent | Like any household budget, rising health care costs are dominating the state’s 2018-19 budget which House members begin debating Monday. Employee health care and government-subsidized health care took more than half of the meager new revenue projected for state coffers for the new budget.

The state is projected to see $492 million in new revenue for the $8.2 billion general fund budget. Of that amount, $326 million is recurring money, meaning it is expected year after year and can provide stable funding for items such as employee benefit increases and pay increases. And that’s where the House’s budget-writing panel has largely directed the pool of new money.

The proposed budget by the House Ways and Means Committee calls for no cuts to state programs or agencies and no tax increases. Click here to see the House budget proposal.

While debate on the House-crafted budget begins next week, but there won’t be much to debate, according to House Republicans and Democrats.

“There is a not a windfall of dollars into the budget but there are certainly many needs within state government,” said Rep. Gary Simrill, who serves as first vice chair to the House Ways and Means Committee. The York Republican said the budget is “well prioritized” and “well thought-out,” adding, “I don’t see any changes that need to be made in the budget.”

After the House passes the budget, it will go to the Senate, where any changes will move it into a House-Senate conference committee before it heads to the governor’s desk. State senators have already begun the committee process for evaluating budget requests.

“It seems to be shaping up for a ho-hum budget year,” said S.C. Sen. Vincent Sheheen, D-Kershaw. He serves on the Senate’s Finance Committee. “We’re barely able to meet our obligations each year. You can’t do anything new or innovative or exciting when you’ve basically have an unstable tax and budget system and you’re struggling every year to keep up with inflation.”

Where the money is going

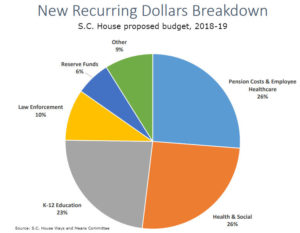

In the proposed House budget for $326 million new recurring revenue, 26 percent will go toward increasing health care costs for state employees, 26 percent will go toward health and social programs, 23 percent will go toward K-12 education, 10 percent will go toward law enforcement and 6 percent will go toward reserve funds. The remaining 9 percent is divvied up among various agencies.

In the proposed House budget for $326 million new recurring revenue, 26 percent will go toward increasing health care costs for state employees, 26 percent will go toward health and social programs, 23 percent will go toward K-12 education, 10 percent will go toward law enforcement and 6 percent will go toward reserve funds. The remaining 9 percent is divvied up among various agencies.

Here’s a breakdown for some of the proposed new spending from recurring revenues:

- $32 million for year two of the state’s pension fund fix.

- $56.4 million to cover health care increases for state employees.

- $26.4 million toward Medicaid to continue same level of service.

- More than $11 million in increased state funding specifically aimed at addressing the opioid epidemic through state agencies.

- $60 million for 2 percent salary increase for teachers.

- $5 million to increase the statewide minimum starting salary for a beginning teacher from $30,000 to $32,000.

- $32 million to maintain the base student cost at $2,425.

- $3 million for school buses.

The lion’s share of the $166 million in non-recurring revenue — 30 percent — will go toward higher education, including $50 million for capital projects and maintenance needs around the state. That revenue stream also includes 15 percent for Department of Social Services Child Support Enforcement System, 3 percent for state school buses — or about $5 million — 7 percent for statewide beach renourishment and more.

Down the road

The House Ways and Means Committee took months crafting the budget, which is expected to be passed before March 15, less than two weeks after all House members receiving the thousand-page tome.

S.C. Rep. Todd Rutherford, the House minority leader from Richland County, who also serves on Ways and Means, said any changes to the budget now is “shuffling chairs on the Titanic.”

“It’d be hard for someone else to step in to say, ‘I want this money here or there,’” Rutherford said. That money would have to come from somewhere else. “We’re talking about things that are absolute necessities.”

On the other side of the aisle but in the same committee, Simrill agreed, but with a more positive view.

“As this budget was crafted, one reason it went through Ways and Means fairly quickly is because it sought to do the most in the areas we felt were important,” Simrill said. “It couldn’t be a shotgun, it had to be a rifle in the way this was crafted.”

The seemingly lackluster budget leaves potential governance questions to be taken up in the coming years. Republicans, like Simrill, are pushing tax reform and a looming federal tax conformity question as an answer toward helping the state meet its obligations. Democrats, like Sheheen and Rutherford, want to see other revenue options explored.

“The Republican leadership simply wants to charge people more on their taxes and it’s a recipe for disaster,” Rutherford said. “I don’t want to raise taxes; I want to go and get revenue from other sources. At some point this state has got to wake up and realize if we don’t bring in new revenue we are simply going backwards.”

Rutherford pointed to legalizing luxury gaming and marijuana — moves taken in other states — that could bring in a hefty revenue stream to the state. In Nevada, where recreational marijuana was legalized, the state saw $30 million windfall in six months. In South Carolina, the question of medical marijuana remains stymied in committee.

Simrill was dubious such new revenue streams would be all profit.

“More money is not the only answer. Depending on how you derive revenue there’s a cost to deriving revenue,” Simrill said. He added the best solution is to “right-size and spread the tax base better through tax reform and conformity.”

One seemingly bipartisan question remains: taking on debt to meet obligations. In past interviews with Statehouse Report, Ways and Means Chair Brian White, R-Anderson, has expressed support for increasing the state’s dwindling debt load to pay for items such as building repairs. But bonding is expected to wait at least until next session,, lawmakers said

- Have a comment? Send to: feedback@statehousereport.com.

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!